If you’ve ever considered opening a retirement, investment, or savings account, chances are you’ve come across something called compound interest. Compound interest works differently from simple interest, and understanding how it is calculated and how it affects your annual returns can help you boost the interest you earn on your money.

So what is this magic of compounding interest everyone keeps talking about?

In its simplest form, compound interest is interest that is calculated not only based on your initial investment amount but also everything you’ve earned in interest and kept in your account over time.

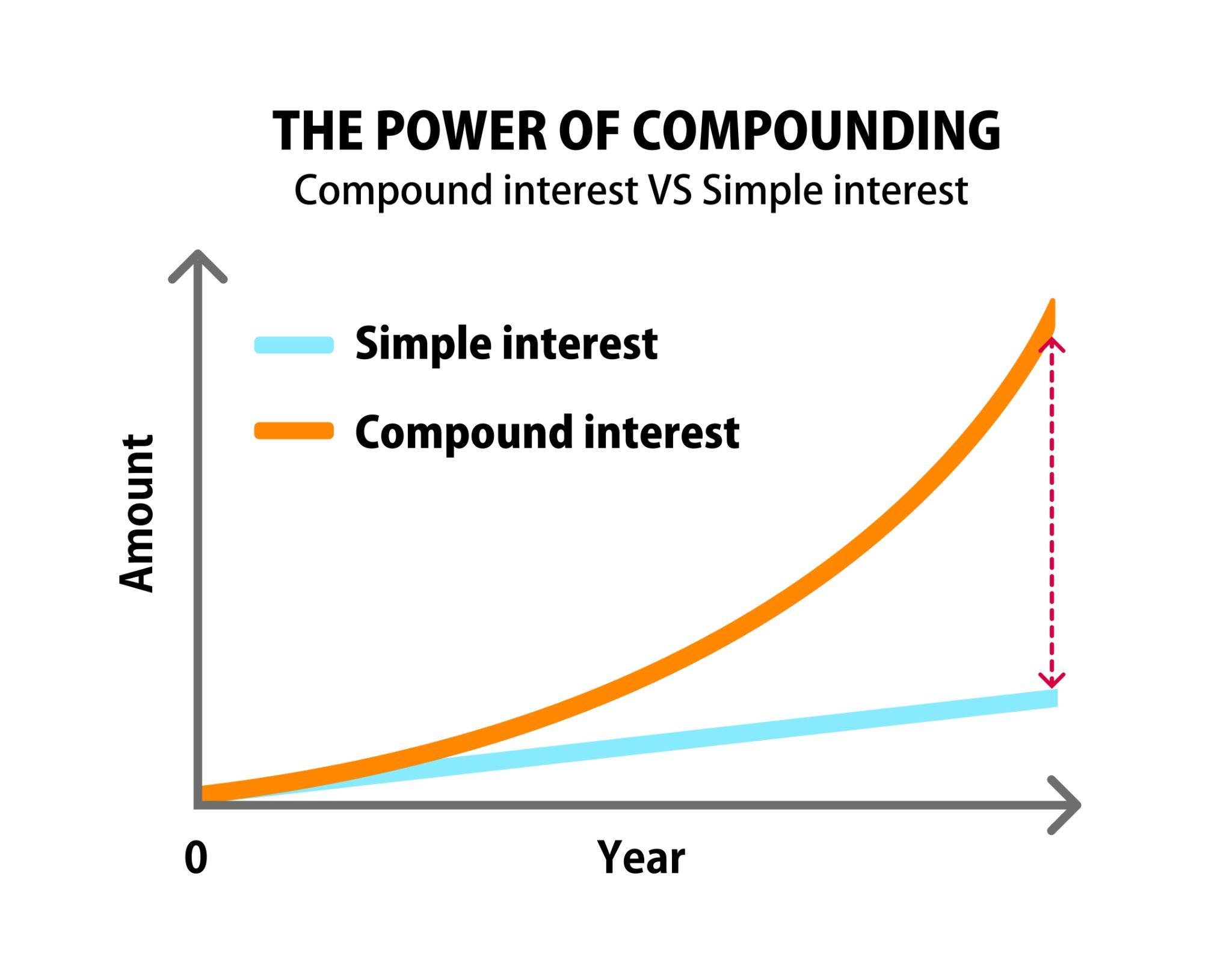

To get a clearer understanding of compound interest, it helps to compare it to simple interest.

Compound Interest vs. Simple Interest

Simple interest is where you get the same amount every year on your initial investment. For example, you invest $5,000 at 7% simple interest. Using the simple interest formula, at the end of one year, you would get $350. Now you would have $5,350. At the end of the second year, you would get another $350 and would now have $5,700. You would continue to earn $350 a year for as long as you kept the investment.

With compound interest, things work slightly differently. Using the same initial investment of $5,000 at 7% interest, at the end of the first year would also have $5,350. However, compound interest is calculated on the entire amount—the initial investment and any previously paid interest payments. So, at the end of year two, you would get $374.50 and now would have $5,724.50. At the end of year three, you would earn $400.72 in interest and now have $6,125.22.

Simple vs. Compound Interest Calculations: Why Compound Interest Matters

Initially, for the first few years, there is not much difference in the growth of investments with either type of interest, but compound interest investments are still better. Over time, they will grow significantly faster. In addition, the number of interest payment periods can further help to grow an initial investment.

To illustrate this concept, let’s look at our original example of investing $5,000 at 7% compound interest and how compounding frequency affects your interest payments.

| Length of Investment | ||||

| 1 Year | 5 Years | 10 Years | 20 Years | |

| Annual Compounding | $ 5,350.00 | $ 7,012.76 | $9,835.76 | $ 19,348.42 |

| Quarterly Compounding | $ 5,359.30 | $ 7,073.89 | $ 10,007.99 | $ 20,031.96 |

| Monthly Compounding | $ 5,361.45 | $ 7,088.13 | $ 10,048.31 | $ 20,193.69 |

The more frequently your investment interest rate compounds, the more money you stand to make in the long run. An investment account with the same initial amount that is compounded daily will therefore earn you a lot more money than one compounding annually, even if the daily account has a lower overall interest rate.

Understanding this difference is crucial to making smart investment decisions. It may be tempting to simply invest your money in the account that offers the highest rate of return while overlooking a lower interest rate offered from a compounding investment account.

However, once you calculate how much money you stand to earn over a set period from both accounts, the power of compound interest could result in the account with a lower initial interest rate being far more profitable.

Compound Interest Calculations

If you’re considering an investment, savings, or retirement account, and you’re not sure whether a compound or simple interest rate will serve you better, the best thing to do is calculate the amount of interest you stand to earn from both over time.

To do this, use the compound or simple interest formula described below.

Compound Interest Formula

X = P(1 + i/f)^ft

X= the final amount in your investment account

P= the principal, or initial, amount you invested

i= The compound interest rate as a decimal number (eg. 7% is the same as 0.07)

f= the compounding frequency

t= time period in years

With X being the final amount of money in your account after your investment period, here’s what the other variables mean:

- P (Principal): The initial amount of money you invested when you opened the account. If you decide to invest $5,000 for five years, $5,000 would be your principal.

- i (Interest Rate): The average interest rate you expect your investment to grow at per year. If your interest rate is 7%, use 0.07 here.

- f (Compounding Frequency): = number of times your interest compounds per year

- t (Time): the amount of time in years

How to Use Compound Interest to Your Advantage When It Comes to Investing

The best way to take advantage of compound interest and its ability to help grow your savings and investments is to start setting aside money sooner, rather than later.

The more time, the greater the return on your money. For instance, using our example amount of $5,000 at 7% compound interest, if you were to invest $800 a month on top of the initial $5,000 for thirty years, at the end of that time you would have just over $1 million.

Now, let’s say you only have 20 years to invest using the same amounts; you would only have $439,366.01 at the end of that time. As you can see, your investment more than doubles from year 20 to year 30. If you wanted to retire with $1 million in 20 years, you would need to invest $1,900 a month, compared to $800 a month over 30 years. This is the power of compound interest.

Compound Interest Investments

Some of the best compound interest investments you can make include:

Certificates of Deposit (CDs)

As a new investor looking to take advantage of compound interest, opting for the safest savings or investment option that uses it is usually a good place to start. One of these options is certificates of deposit (or CDs).

CDs require a minimal deposit and pay interest at regular intervals. Most CDs have terms that range from three months to five years, and you will only have access to your money once this term has passed; otherwise, you may need to pay an early withdrawal penalty fee.

High-Yield Savings Accounts

Although CDs typically offer a higher interest rate, high-yield savings accounts require very low minimum balances (and in some cases none at all). With high-yield savings accounts, you can accrue interest while still enjoying the same safety of FDIC insurance up to $250,000 that applies to traditional savings accounts. High-yield savings accounts usually also allow you to withdraw your money whenever you need it. The only downside is that when inflation rates are high, your rate or return may not be high enough to maintain or increase your investment compared to the increase in prices.

Bonds

Bonds are one of the best, and most popular, compounding investments. They work as though you have given a loan to a creditor (like a bank, business, or government). The creditor then agrees to pay you a specific interest rate in return for your loan.

Bonds do not use compounding interest by default, though. You will need to reinvest any of the interest you gain into bonds to achieve the compounding interest effect.

The level of risk you take by investing in bonds depends on the creditor you are buying them from. Long-term corporate bonds are usually the most risky but also offer the highest interest rates. Government treasury bonds like U.S. Treasury securities are the safest option, as they are backed by the government itself.

Money Market Accounts

Money market accounts are similar to savings accounts in setup and interest rates. Unlike savings accounts and CDs, this option allows you to use debit cards and checks connected to the account, so your money is always accessible to you.

At TPFCU, we offer our members a range of compounding accounts and products to help them achieve financial freedom and stability. Stop by The People’s Federal Credit Union to open a share savings, retirement, or other investment account today, or call us at (806) 359-8571!